Consolidation in electronics retail continues

By Liu Buchen (China Daily)Updated: 2007-07-04 14:12

The author Liu Buchen is a veteran electronics retail consultant and chief consultant at SBFM Consulting in Guangzhou

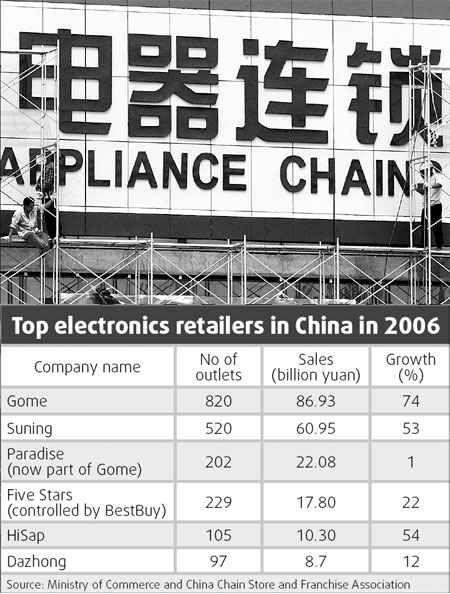

After high-profile mergers and acquisitions between Gome and Paradise, BestBuy and Five Stars in 2006, China's electronics retail market does not show any sign of reduced intensity in consolidation this year.

First, the second-largest player Suning posted a statement saying it would invest 2.4 billion yuan to build 250 chain stores, as well as a logistics center in Shenyang and two flagship stores in Shanghai and Wuhan.

Then BestBuy was rumored to buy No 6 electronics retailer Sanlian in Shandong Province. The biggest electronics chain operator Gome was reported to spend 6.5 billion yuan to increase operational efficiency and improve relations with suppliers, which was followed by the news that Gome will take back product sales in 100 stores from manufacturers' sales representatives.

|

Thus, questions arise: Why is the consolidation activity so intense this year? What is the background? What impacts will these events bring to the market?

In my view, the activity is a sign of the transition from quantity-driven expansion to quality-focused operations.

For a long time, China's retail electronics market has faced problems such as worsening relations between retailers and suppliers, quantity-driven expansion, lack of core competitiveness and low profitability.

In the face of the invasion from BestBuy, a necessary step for domestic retailers is to solve the old problems and reform their businesses. This is the background of changes in this year.

A harmonious relationship

In the eyes of industry observers, the biggest problem for China's retail electronics chains is the tense relationship between retailers and suppliers, as retailers ask for various kinds of charges and use money that they should pay to suppliers for several months without paying interest.

However, this knot is harmful to appliance manufacturers and does no good to retailers.

| |||

However, this is a commitment that is difficult to honor. The business model of many Chinese electronics retailers includes abuses of manufacturers and suppliers, namely from entry fees, special fees for festivals and anniversaries, and delayed payments to vendors. So, how far Gome can really go is something hard to say.

International practice

In almost 30 years of history of China's reform and opening up, we have

realized that the country will have to experience what developed nations have

experienced. Retail electronics is no exception.

| 1 | 2 |  |

(For more biz stories, please visit Industry Updates)