Interest rates set to rise

By Hong Guan (China Daily)Updated: 2007-04-20 08:25

The release yesterday of China's key economic figures has prompted market speculation that authorities might once again raise interest rates to maintain stable economic growth.

The National Bureau of Statistics (NBS) said yesterday that gross domestic product (GDP) for the first quarter was up 11.1 percent year on year.

Zhu Jianfang, a senior analyst with the Beijing-based CITIC Securities said that although the growth

is strong, it has not become "overheated".

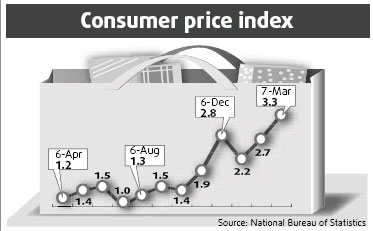

The much-hyped consumer price index (CPI) grew by 2.7 percent year on year during the same period, but in March it rose by 3.3 percent, faster than the official warning line of 3 percent.

The NBS admitted that "there exists certain inflationary pressure", but said that if "the lagged-behind effect of a 1.5-percent increase in food prices last year" was taken into account, the true increase in the CPI in the first quarter was only 1.2 percent.

Shen Minggao, an economist with Citigroup in Beijing, agreed.

"Inflationary risk is not as serious as the CPI figure (in March) seems to convey," he said.

Zhu said that despite the alarming March figure, the CPI would not rise continually. It indicated just "moderate" inflation.

However, given the fact that the CPI, GDP and money supply which increased by 17.3 percent, 1.3 percentage points more than the central bank target had all exceeded official benchmarks, economists agreed that interest rate hikes were likely to follow.

Shen said the central bank might raise the interest rate by 27 basis points ahead of the May Day holiday. It might also raise banks' deposit reserve requirement ratio a further two times this year.

So far this year, the interest rate has been increased once and the banks' deposit reserve requirement three times.

Zhu said pressure on the authorities to raise the interest rate was increasing.

"The central bank will closely monitor the growth trends of prices, investment and lending to decide whether it is necessary to take prompt measures," he said.

On hearing the latest figures, Standard Chartered Bank adjusted its forecasts.

"We hereby upgrade our 2007 GDP forecast to 10.6 percent, from 9.6 percent," it said in a note to its clients.

The bank also upped its interest rate forecast, saying that it would rise twice before the end of the year, once in the second quarter and once in the third.

"We believe that two interest rate hikes are now only a

matter of time," the note said.

"We believe that two interest rate hikes are now only a

matter of time," the note said.

HSBC (China)'s chief economist Qu Hongbin said that given the macroeconomic figures, he expected authorities to impose further tightening measures, such as controls on liquidity, lifting banks' reserve ratio and raising the interest rate. But he said he did not expect the economy to slow down significantly.

"We believe the central bank still has room to lift the reserve ratio by a further 2 to 3 percent in the coming quarters."

Qu said that lifting the interest rate "should help cool investment overheating, CPI inflation and over-optimism on returns from yuan-based assets, and discourage unwanted portfolio inflows".

He also believed the central bank would raise the interest rate by at least 27 basis points in the coming weeks, followed by at least one further hike in the second half of the year.

Lehman Brothers made the boldest forecast, saying the rate would rise by 27 basis points in the coming weeks, "possibly as soon as today".

It said in a note that the good news for the economy was that retail sales in March grew 15.3 percent year on year, 60 basis points higher than in the first two months, which suggested consumption had picked up strongly.

(China Daily 04/20/2007 page4)

(For more biz stories, please visit Industry Updates)