Women managers rising through the ranks

|

|

A chartered financial analyst offers investment advice to prospective clients at an international financial expo in Shenzhen, Guangdong province. [Photo provided to China Daily] |

Talent shortage in Asia, especially in China, creates opportunities in male-led bastions

For a long time, female fund managers were viewed as something of an endangered species in the investment sector. While that may well be case in some countries, things are quietly changing in Asia as more women move up the ranks in the male-dominated industry.

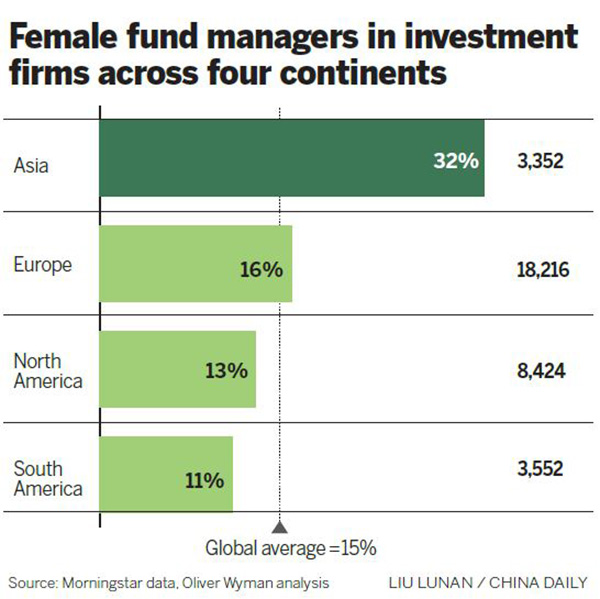

Research by management consulting firm Oliver Wyman has found that Asia has by far the highest representation of women in asset management, comprising 32 percent of portfolio managers as of December 2015, more than double the global average of 15 percent.

The number in China is also encouraging. Female managers ran nearly a quarter (24.2 percent) of mutual funds in China as of March this year, according to Chinese financial data research firm Wind Info. This compared with only 2 percent of assets and open-end funds in the United States being managed by women, according to a report by data provider Morningstar.

Rapid economic development in Asian countries and the relatively short development history of the financial industry there has resulted in acute skills shortage, which is creating more opportunities for women to move forward in their careers in finance, industry experts said.

They said the demand for skilled and experienced investment professionals may also prompt employers in Asia to overlook concerns about a woman's current or future family commitments.

"The industry here really started taking off only in the last 15 to 20 years and this is a period when the industry needed lots of new professionals quickly and firms were willing to search beyond the traditional talent pool to recruit and promote female investment professionals," said Gillian Kwek, a portfolio manager with Fidelity International in Singapore.

Kwek, who has more than 15 years of experience in the asset management industry, said that easier access to domestic help-including support from parents living nearby who were happy to help out with family matters such as baby sitting-could also help to explain the higher female representation in Asia than in the US and Europe.

In addition, the larger talent pool of qualified women in the finance industry was also seen as one of the reasons why there were more female fund managers in Asia than elsewhere.

The latest research on gender diversity in investment management by the CFA Institute found that seven out of the eight countries with the highest percentages of women CFA (Chartered Financial Analyst) members were in Asia.

Vietnam has the highest percentage of 43 percent of female CFA members while the Chinese mainland was ranked fourth with 31.3 percent of women CFA members. The number is only 16.4 percent in the US.

"In China, we have seen more women moving up the ranks in the investment management industry," said Jia Lijun, head of the CFA Institute's China branch, noting that there will be more opportunities for women as China's financial industry matures and continues to develop.

"As a veteran with more than 30 years in the financial services industry, I am absolutely positive that leading investment firms in China are starting to actively seek a wide range of perspectives and are gradually realizing that diversity in decision-making is good for clients, teams and business," he said.

The rise of information technology and the boom in the financial technology (fintech) sector in China have also contributed to higher female representation in the finance industry.

"The internet has become a main driver of growth and there is a shortage of good talent. This has created more opportunities for women to move forward in their careers, not because they are women but because they are good managers," Pan Jing, chief marketing officer of the Chinese online financing firm Dianrong.com, was quoted as saying in the survey by Oliver Wyman.

Despite the encouraging trend in Asia, empirical evidence and industry research still point to the trend that woman are scarce in the financial services industry on a global basis and are underrepresented relative to other professions.

Globally, only 18 percent of CFA members are women, well below the percentage of female workers around the world, according to the research by the CFA Institute.

In the financial services industry, women occupied only 16 percent of positions at the executive committee level, the Wyman report showed.

Experts said that the fact that finance is a profession that disproportionately rewards those who work long and inflexible hours, could be a factor that discourages women from entering the industry. Family responsibilities and insufficient flexible working hours often lead to a mid-career conflict and a less attractive "career trade-off" for women than men, they said.

The image of the investment industry, which is often seen as a competitive, aggressive and harsh profession, has also affected its attractiveness as a destination for female graduates, some experts said.

Nonetheless, Fidelity International's Kwek said that it was reasonable to expect the industry to embrace greater gender diversity as her clients are becoming more diverse.

"As women control more financial assets and make more financial decisions about their investments, the expectation is also there for more women portfolio managers to manage their savings," she said.