Supermarts fight it out for local dominance

By Cheng Feng (China Daily)Updated: 2007-07-06 10:53

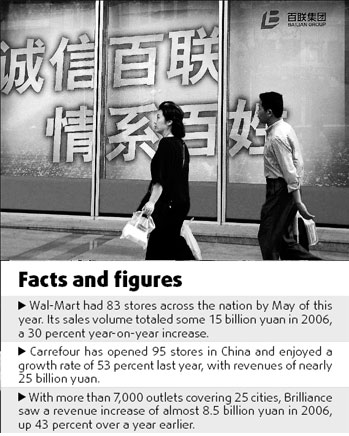

A government-initiated program to establish large retail groups to compete with the foreign mega-store operators like Wal-Mart from the United States and Carrefour of France, is seen to be producing results in the highly competitive Shanghai marketplace.

The lessons learned by these domestic retail conglomerates in Shanghai, led by Brilliance Group, which owns a chain of stores under names such as Hualian and YiBai, will be incorporated into operational models that can be applied nationwide, retail experts and economists said.

Although large foreign chains continue to increase their presence in

Shanghai, domestic brands are fast catching up, as indicated by new store

openings and revenues, the experts said.

With more than 7,000 outlets covering 25 cities, Brilliance saw a revenue increase of almost 8.5 billion yuan in 2006, up 43 percent over a year earlier.

In 2003, four local retailers, Shanghai YiBai (Group) Co Ltd, Hualian (Group) Co Ltd, Shanghai Friendship (Group) Co Ltd, and Shanghai Materials (Group) Corp, merged into Brilliance Group to compete with the muscle of incoming foreign companies.

Wang Liang, head of the Shanghai Current Economics Research Institute attributed Brilliance Group's speedy expansion largely to its concentration of assets, capital and network. He said the combination cut costs of stock, management and delivery that improved profits.

Local companies also boast the advantage of good supply chains. Suppliers have more trust in large State-owned enterprises such as Brilliance Group, Wang said, noting that a stable chain of suppliers is already established for these large local retailers.

"Suppliers are more willing to sustain this chain than providing goods to newcomers with an unforeseen future," he said.

Yet foreign companies' financial support wins them favor from Chinese suppliers. Wal-Mart's bankroll enables it to pay 60 percent of the total purchase price to suppliers immediately.

| |||

In contrast, many Chinese supermarkets, following the example of Carrefour, pay suppliers once every six months.

"It shifts the risk to suppliers and puts them in an embarrassing shortage of cash flow. That may harm their supply chain."

Foreign companies also gained a favorable foothold through mergers.

Wal-Mart's acquisition of a 35 percent stake in Trust Mart in February this year

was a classic example.

| 1 | 2 |  |

(For more biz stories, please visit Industry Updates)

|

|