Time to shine light on tax evaders

By Liu Shinan (China Daily)Updated: 2007-04-11 10:19

The State Administration of Taxation failed to announce the final statistics on high earners' reporting their income by yesterday as promised. The announcement was postponed once again.

The postponement is sure to give rise to the suspicion that there is still a significant disparity between the numbers of those who have reported their income and those who should have done so.

The latest available statistics indicate that as of March

29, some 1.38 million people had reported their personal income for 2006, while

the actual number of high-earners with incomes of at least 120,000 yuan

($15,000) a year - the criterion for declaration - is estimated by financial

experts at more than 6 million.

The latest available statistics indicate that as of March

29, some 1.38 million people had reported their personal income for 2006, while

the actual number of high-earners with incomes of at least 120,000 yuan

($15,000) a year - the criterion for declaration - is estimated by financial

experts at more than 6 million.

The tax authorities said earlier that they had "obtained sufficient information about most of the people" whose income has reached the threshold for reporting. They also warned of serious punishment for those who fail to declare their income.

Now that the April 2 deadline for reporting has passed, the whole nation will watch whether the authorities keep their word on punishing violators.

Any failure in keeping their word will discredit government authority, given that this is the first time that the government has required income declarations and the first time that punishment was explicitly detailed.

Though the final figures of tax declaration have not yet come out, it looks like there will be no change in the fact that the number of non-declarers far exceeds that of those reporting their income.

The huge gap will undoubtedly further fuel public anger over what is believed to be the phenomenon of "milking the poor to nourish the rich", since middle- and lower-income earners are believed to be the main contributors to the personal income tax, although there are no official statistics about the actual makeup of the spectrum.

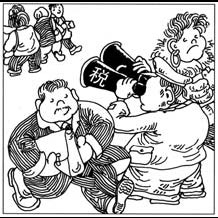

China Daily published a cartoon yesterday showing the beam of a torch held by the tax authorities spotting only the wage earner while failing to see the self-employed entrepreneurs, real estate developers, business owners and celebrities crouched in darkness. The cartoon vividly mirrors the current situation of China's taxation of personal income.

It is understandable that it is more difficult to monitor the income of big

money makers. But this does not justify any tolerance of the fact that

four-fifths of high earners appear to be hiding their incomes (as shown by the

March 29 figures).

In fact, due to insufficient official data, it is unknown how many of the estimated 5 million high earners who have not declared their personal income tax are non-wage earners. The actual number of individuals with incomes of at least 120,000 yuan could well surpass this figure.

What is more, cheating on personal income tax represents only a part of tax evasion in this country. Inefficient monitoring of corporate profits is more serious. Taxation departments throughout the country need to improve their work in monitoring both corporate and personal income. This involves two things: the will to monitor and the capability to monitor.

The first concerns the quality of the tax officials; the second concerns the means by which the officials can exercise efficient monitoring, for instance, the establishment of a nation-wide electronic network of information.

Calls to strengthen income monitoring have been sounding for years but monitoring has remained weak. Substantive moves should be taken without delay. As the first step, the authorities should announce the final figures on personal income reporting and honor their promise of punishment.

Email: liushinan@chinadaily.com.cn

(China Daily 04/11/2007 page10)

(For more biz stories, please visit Industry Updates)