Firms bank on secure transactions

By Zhang Ran (China Daily)Updated: 2007-03-27 08:56

On March 17, Huang Anquan, a stock investor in East China's

Fujian Province, found a mysterious 10-million-yuan deposit in

his account with Fuzhou-based Guangfa Huafu Securities. It disappeared from his

account a day later.

On March 17, Huang Anquan, a stock investor in East China's

Fujian Province, found a mysterious 10-million-yuan deposit in

his account with Fuzhou-based Guangfa Huafu Securities. It disappeared from his

account a day later.

The brokerage firm told Huang the money appeared in his account because of a temporary breakdown of the firm's IT transaction system. The story later changed, with the firm insisting the deposit appeared because of Internet testing it was carrying out.

The firm's responses did nothing to ease Huang's doubts about the security of his Internet transactions. The error was reported by the Economic Information Daily, raising security concerns among stock investors.

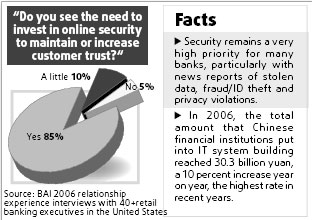

A recent survey conducted by Unisys Finance Services, part of Unisys, a worldwide leading IT solutions provider, showed that while burgeoning electronic storage and transmission of data has provided convenience and value for consumers and businesses alike, it has also created opportunities for criminal activities.

Security is paramount if financial services firms are to earn their clients' trust.

Several online brokerage firms reported in October 2006 that hackers had entered their computer systems and made unauthorized trades, resulting in millions of dollars worth of customer losses.

Cases of lost, stolen or exposed personal data are frequently in the headlines. This raises doubt as to whether any institution can be trusted with funds or personal information.

A Unisys survey of 6,492 bank and credit card account holders from eight countries in 2005 found that two-thirds of the respondents worried about identity fraud and the safety of their bank and credit card accounts.

These concerns pose a serious challenge to many businesses and other organizations that are custodians of personal information. But the challenge is particularly acute for banks and brokerage firms, for which security, trust and business performance are so entwined.

"The challenge more than just to pay lip service to the relationship between security, trust and business performance is to put appropriate processes and technology in place to support those processes," said Reuben Khoo, vice-president and managing director of Unisys Financial Services Asia Pacific.

As an IT solutions supplier, Khoo helps banks improve their client relationship management.

Guo Tianyong, director of the banking research center at the Central

University of Finance and Economics, said Chinese banks' IT infrastructure, especially

at emerging commercial banks, was still at a lower level compared to their

foreign rivals.

| 1 | 2 |  |

(For more biz stories, please visit Industry Updates)